release:

update:

Understanding the 2022 Amendments to the Electronic Bookkeeping Law and Grace Periods

Table of contents

- The categories of electronic data storage under the act

- Electronic Bookkeeping Law – Key Points of the 2022 Revision

- (1) Abolition of the pre-approval system and relaxation of preservation requirements

- (2) Relaxation of time stamp requirements for scanner storage

- (3) Abolishment of proper administrative processing requirements

- (4)Relaxation of search requirements

- (5) Abolishment of written storage method

- (6) Strengthening penalties

- What is the grace period for the 2021 Amendment to the Electronic Bookkeeping Law?

- SignTime’s response to the “Electronic Bookkeeping Law”

- Summary

What is the Electronic Bookkeeping Law?

First, some history: enacted in 1998, the law allows the storage of invoices and receipts for tax returns as electronic data. In 2005, “scanned data” was also recognized as electronic data.

In 2016, it was further relaxed to allow more electronic storage, and it became possible to store receipts and bills taken with smartphones.

See the article about the 2024 – Electronic Bookkeeping Preservation Act Compliance.

The categories of electronic data storage under the act

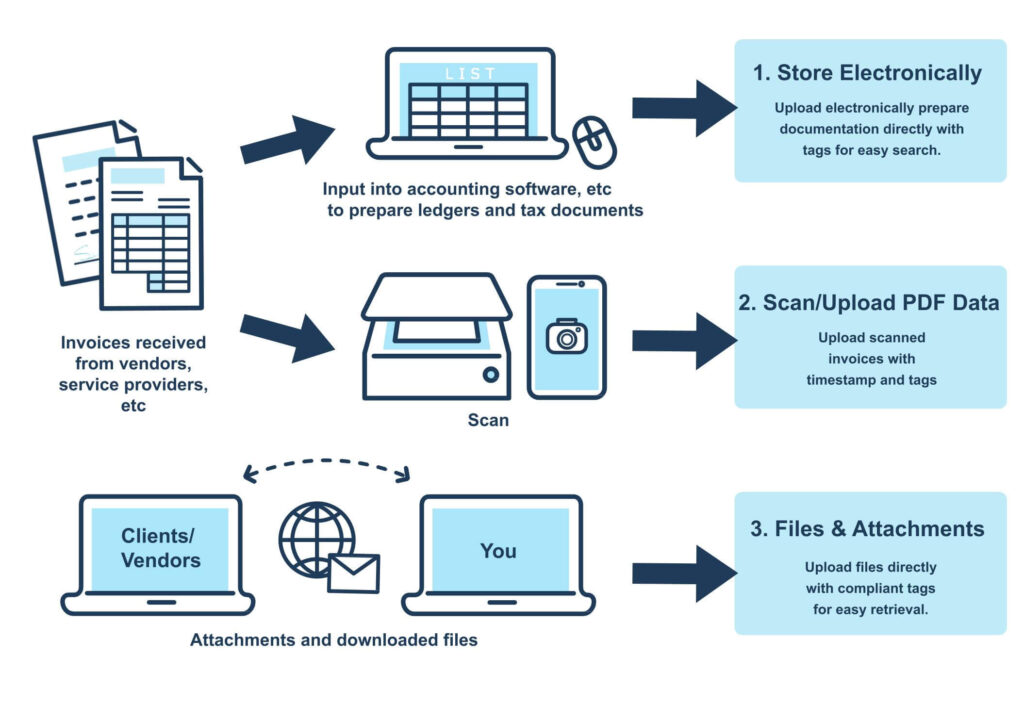

Preservation of electronic data records is broadly classified into the following three categories.

(1) Storage of electronic books

Accounting books (journals, etc.) and national tax-related documents (accounting-related documents, etc.) that are consistently created using a computer from the initial recording stage shall, under certain requirements, be processed electronically.

It may sound difficult, but to put it simply, if the books and records originated electronically, then it is fine for them to be used and stay that way for accounting and tax purposes. However, businesses need to be careful because accounts kept on paper can fall within the scope of scanner storage (see below).

(2) Scanner storage

For national tax-related documents (quotations, contracts, invoices, etc.), excluding financial statement-related documents, it is possible to replace the storage of such documents by storing electromagnetic records recorded by a scanner under certain requirements.

Even if the books were originally kept on paper, if certain requirements are met, it is fine to save the images as data via scanned images.

(3) Data storage related to electronic transactions

Regarding income tax (excluding income tax related to withholding) and corporate tax records, when electronic transactions are performed, electronic transaction information must be stored as electronic records under certain requirements.

In some cases involving tax records, the Act requires that transaction information exchanged electronically (via e-mail, website, etc.) with another party to the transaction, must be stored as data. If you download an invoice from an internet bank or website, to use a familiar example, or the payment history when purchasing from Amazon or other electronic retailers, these records will also fall under this category.

Electronic Bookkeeping Law – Key Points of the 2022 Revision

The January 2022 revision aimed to promote paperless transactions. As digitalization and paperless commerce progresses in Japan, restrictions have been eased with the aim of improving productivity by digitizing some accounting functions. The Act encourages the storage of electronic data, and works to reduce printing and paper storage costs, encourage digital and hybrid work style reforms.

In the Act, the requirements for paperless and electronic data storage have been “relaxed.” Here are some of the changes that were made in the 2022 revision.

(1) Abolition of the pre-approval system and relaxation of preservation requirements

Before revision:

- When introducing electronic data storage or scanner storage for national tax-related documents, it was necessary to apply for prior approval from the National Tax Agency

- It was necessary to submit an approval application form 3 months before the start of the work

After revision:

- Prior approval is no longer required

- This applies to books and electronic documents that were to be stored after January 1, 2022.

(2) Relaxation of time stamp requirements for scanner storage

Before revision:

- A time stamp is required within 3 business days after receiving electronic data and signing

After revision:

- Time stamping period for scanner storage is further relaxed

- Time stamps are not required if the scanned data is stored in the cloud, where the fact and content of corrections and deletions can be confirmed within 2 months and 7 business days

- When the recipient of the document reads it with a scanner electronically, it is no longer necessary to sign it

- The revisions made in 2021 will be applied to documents scanned and stored after January 1, 2022

(3) Abolishment of proper administrative processing requirements

Before Revision:

- It is necessary to formulate internal rules and establish internal controls, such as establishing a check system with two or more people, for the three items of mutual checks, periodic inspections

- *To respond to regular inspections of national tax-related documents

After revision:

- Requirements for “proper business practices” have been abolished, eliminating the need for internal regulations and internal controls

(4)Relaxation of search requirements

Before revision:

- When storing national tax-related documents as electronic data, “search items such as transaction date, account item, transaction amount, type of document such as invoice, receipt, etc.” are required.

- You need to search by specifying a range for “Date/Amount”

- It is also necessary to be able to search by combining two or more arbitrary items

After revision:

- Required search items are limited to “Date/Amount/Customer” only

- If the National Tax Agency can respond to requests for electronic data download, there is no need to specify ranges or combine multiple items to search

(5) Abolishment of written storage method

Before the revision:

- Regarding income tax, corporate tax, etc., the method of outputting electronic transaction data and storing it on paper was permitted

After revision:

- For electronic transactions, the method of storing data on paper is not permitted, and data must be stored

(6) Strengthening penalties

While paperless operations are becoming more convenient, the penalties will be stronger if there are any deficiencies in tax processing in scanner storage or electronic transactions. Fraud and omissions, such as concealment and falsification, are subject to an additional 10% on top of the double tax normally imposed.

What is the grace period for the 2021 Amendment to the Electronic Bookkeeping Law?

Due to the revision of the Electronic Bookkeeping Law, the method of saving electronic data acquired in electronic transactions on paper is no longer permitted. In other words, it is necessary to save data “in an electronic form.” Because some business operators need to prepare for this revision, a grace provision was established.

According to the “2021 Tax Reform Outline” announced on Friday, December 10, 2021, the obligation to store electronic data related to electronic transactions, which was scheduled to be mandatory from January 1, 2022, a grace period of two years was provided. With this change, receipts, invoices, quotations, contracts, and EDI/cloud transactions received in electronic data format will be allowed to be stored on paper for two years only “if there are unavoidable circumstances.”

No special notification is required, but you must be prepared to respond to requests for presentation and submissions from the tax office even during the grace period

SignTime’s response to the “Electronic Bookkeeping Law”

Since contracts using SignTime are sent and received as electronic data, they fall under the “electronic transactions” section under the Electronic Bookkeeping Law.

There are three important points in electronic trading:

- It is not necessary to print or save electronic data on paper

- Proof of identity and non-falsification (addition of electronic signature and time stamp, creation of administrative processing rules, etc.) is required

- When saving, date, amount, and other search functions for business partners is required

SignTime’s electronic contracting services records who, when, and from which IP address has signed a contract, and has strong security and tamper controls, so that the contents of a contract cannot be rewritten after the contract is concluded. In addition, it is the only electronic contract service in Japan that has “blockchain linkages”, making it possible to clearly prove that a contract has not been tampered with.

Additionally, by utilizing the tag function of documents in the SignTime app, it is possible to search by “date, amount, business partner” stipulated in the revised search requirements in the Act.

Summary

- The Electronic Book Storage Act has three categories: “storage of electronic books,” “scanner storage” and “electronic transactions.”

- With the revision in January 2022, the requirements for paperless and electronic data storage will be relaxed.

- Electronic storage of receipts and invoices received as electronic data will be postponed for two years, and paper storage is possible for additional time.

| Reference material:National Tax Agency “Electronic Bookkeeping Law” Questions and Answers [Electronic Transactions]” (July 2021)National Tax Agency: The Electronic Book Storage Act was revised (May 2021)National Tax Agency 2021 revision Electronic Bookkeeping Law YouTube video “National Tax Agency video channel” material |